Everything You Need to Know About Purchasing Flood Insurance

Table of Contents

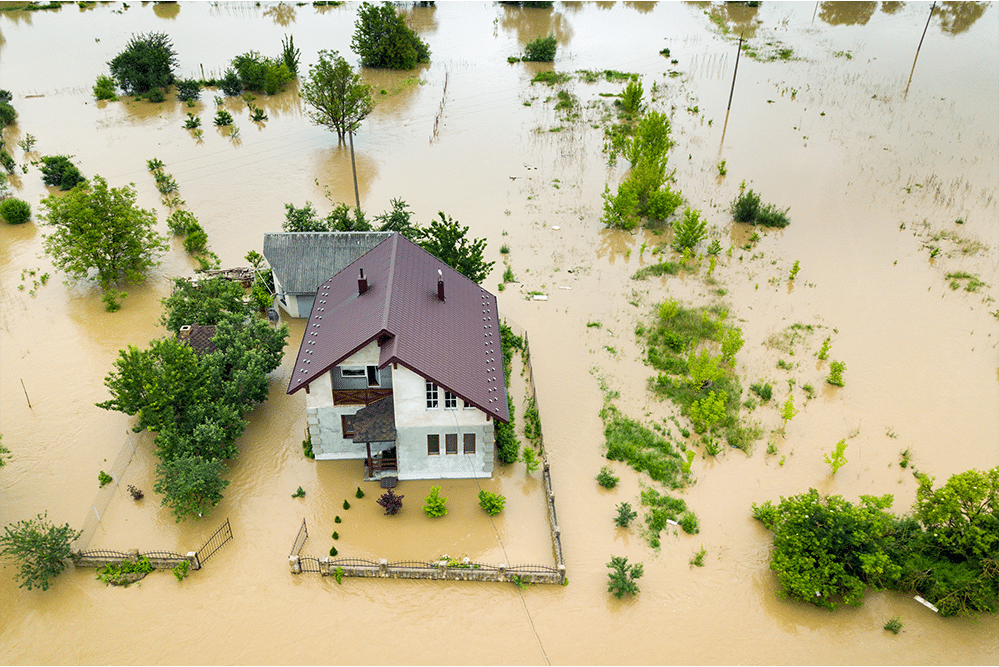

Flooding is a natural disaster that has caused extensive damage to homes and businesses in many parts of the world. It can be financially devastating, leaving victims with repair costs they may not have anticipated or budgeted for. Purchasing flood insurance protects against potential financial loss, but it is essential to understand what it covers and any associated restrictions or qualifications. It will provide an overview of everything one needs to know about purchasing flood insurance to make informed decisions when choosing coverage.

The first part of this article will discuss why flood insurance is essential and how much coverage one should purchase based on circumstances. Additionally, various types of policies are available from different insurers, which will be examined in detail. Finally, eligibility requirements for obtaining flood insurance and tips for finding the best deals on coverage will be discussed.

Overall, understanding all aspects of purchasing flood insurance ensures that individuals and business owners can protect themselves adequately against flooding-related damages without overpaying for unnecessary coverage. Reading this article carefully will give readers a comprehensive knowledge base regarding flood insurance purchases.

Understanding Flood Insurance

Flood insurance is a policy that provides coverage against damage caused by flooding. It can be purchased through private insurers or the National Flood Insurance Program (NFIP), which the federal government administers. Purchasing flood insurance is essential for those at risk of flooding, as homeowners insurance policies typically do not cover natural disasters.

When determining eligibility for a flood insurance policy, high-risk areas are considered. These areas may include coastal regions and near bodies of water, where flooding is more likely to occur due to climate conditions and geography. Property location, type of building construction, elevation levels, and history of past floods in the area should also be considered when deciding if you need a flood policy.

It’s important to consider all aspects when assessing your risk of flooding before purchasing or renewing a flood insurance policy. Doing so will better inform you how much coverage you need to protect yourself from this potential disaster. Transitioning into the following section: Determining eligibility for flood insurance requires careful consideration of numerous factors related to your home’s location and other associated characteristics.

Determining Eligibility

Approximately 20% of flood claims are estimated to come from properties outside the high-risk flood zone. Flood insurance coverage can be an essential financial tool for those who live near a body of water or experience temporary flooding conditions due to storms and storm surges.

When evaluating flood insurance, it is essential to consider what type of coverage you need. There are two types: contents coverage, which covers personal items lost due to flooding, and building coverage, which protects the structure from damage caused by floods. Additionally, excess flood insurance policies may help cover more in-depth costs associated with rebuilding after a significant event.

The cost of premiums for flood insurance varies depending on location and level of risk, but all policies must be purchased through the National Flood Insurance Program (NFIP). It should also be noted that federal disaster assistance payouts cannot replace traditional flood insurance, so having both may provide additional protection against loss or damage during extreme weather events.

Evaluating Coverage Options

Evaluating coverage options is an essential step in purchasing flood insurance. When assessing the various types of coverage available, it is critical to consider the flood map for a particular area and its respective risk level. Private flood insurance policies may be applicable for those living in low-risk areas or outside designated flood zones, as these are not eligible for primary flood insurance through the National Flood Insurance Program (NFIP). However, if located within a FEMA-identified high-risk zone, NFIP provides supplemental flash flood coverage. It is also necessary to review specific requirements when obtaining NFIP coverage, such as verifying that all structures on the property meet federal building codes and local ordinance standards.

Additionally, evaluating how much coverage will be required based on current replacement costs should factor into making any decisions.

Furthermore, understanding the distinctions between different types of flood damage included with each policy is essential before finalizing a purchase. Making an informed decision about what type of protection best meets individual needs requires analyzing data from multiple sources and comparing them against one another. To achieve this goal effectively, studying up-to-date Flood Insurance Rate Maps and details related to claims processes helps ensure more detailed information can be obtained before selecting a provider. Comparing costs then becomes easier since key factors have already been evaluated beforehand.

Comparing Costs

Comparing flood insurance costs is essential for property owners to understand their risk and determine if purchasing a policy is cost-effective. Different types of water damage are usually not covered by standard homeowners policies, meaning those living in areas with higher flooding risks must consider additional coverage options. Flood insurance policies can be purchased from private insurance companies or through the National Flood Insurance Program (NFIP).

Homeowners who wish to purchase a flood insurance policy should first research disaster assistance programs offered after a federal disaster declaration. These may provide temporary relief while they seek out more permanent solutions such as personal property coverage. Costs vary depending on where one lives; however, most plans will cover damages related to floods due to heavy rains, hurricanes, and other natural events. Additionally, certain items like basements and landscaping may have separate rates associated with them.

Property owners should also compare deductibles when shopping around for different policies. For instance, low-risk properties might get away with paying lower monthly premiums. Still, they may require larger deductibles than high-risk properties to receive full benefits. Ultimately, ensuring you’re getting adequate protection at an affordable price before buying a flood insurance policy is essential.

Applying For Coverage

One of the most critical steps when purchasing flood insurance is applying for coverage. From understanding your risk level and relevant bodies of water to finding a licensed agent who can help customize a policy – there’s no denying that getting the correct type of protection for your property requires careful consideration. Here are just some of the things you need to consider before applying for coverage:

• Flood maps – Check with your local Flood Map Service Center (MSC) to see if your area is at risk from flooding or potentially subject to damage from other sources, such as broken water tanks.

• Separate policies – Homeowners’ policies may not cover damage caused by floods, so make sure you get a separate flood insurance policy that provides building and personal contents coverage.

• Licensed agents – Licensed agents can access different markets and advise on the best plans available based on your specific needs.

• Bodies of water – If you live near large bodies of water, you should check whether they are covered by the National Flood Insurance Program (NFIP).

• Water tanks – Consider any possible risks associated with having water tanks in areas prone to flooding, as this could lead to additional costs.

Considering all these factors, it’s time to look into potential providers and assess what kind of coverage will protect against potential losses due to flooding events. Other events that might be covered include flash floods, mudflows, typhoons, hurricanes, and more.

Different Types Of Events Flood Insurance Covers

Flood insurance is a lifesaver for many homeowners, and it’s essential to understand the types of events covered. With various coverage options, navigating through them can feel like sailing in uncharted waters. But fear not! This guide will provide everything you need to know about what floods your policy will protect against.

Typically, flood policies cover damage caused by rising water from rivers or streams, as well as heavy rain storms and coastal storm surges-which can be devastatingly destructive. Policies may also include protection from mudslides due to torrential downpours and melting snow caused by hot temperatures during winter. In addition, they often cover damage resulting from broken levees and other containment structures meant to keep flooding at bay. If floodwaters invade your home, chances are you’re covered (with some exceptions).

Most residential policies come with a 30-day waiting period before taking effect; however, certain items, such as carpeting, clothing, furniture, and electronics, could become damaged due to seepage or humidity-related issues, are excluded. Some policies even extend their coverage to detached garages and personal property outside the structure, including air conditioners and water heaters. Furthermore, suppose the homeowner needs to vacate temporarily while repairs are being made on their house after a flood event. In that case, most policies have provisions for temporary housing costs and debris removal expenses associated with recovery efforts. It’s essential to consider purchasing a policy if one lives near coastal barrier resource systems or in high-risk flood plains. Both areas are prone to natural disasters such as hurricanes, which cause catastrophic damages when flooding occurs.

Taking out inland flood coverage provides peace of mind, knowing that your financial investments are safe should disaster strike, yet understanding the benefits further illuminates why this type of insurance is indispensable for protecting one’s assets over time…

Benefits Of Inland Flood Coverage

Flood insurance is an essential protection for homeowners who live in regions prone to flooding. Knowing the benefits of obtaining inland flood coverage can mean the difference between peace of mind and a financial nightmare in a sudden flooding incident. Here’s what you need to know about this type of policy:

It pays off to have an insurance agent on your side when it comes to navigating potential flood losses, as they will be able to provide valuable insight into which level of cyclical risk covers types of damage. In most cases, additional coverages can be purchased beyond basic policies, such as those associated with damage to buildings or vehicles caused by floods.

When considering coverage limits and policy limits, understanding exactly what kind of flood loss may befall your property helps determine how much insurance coverage you should buy: • Insurance Coverage – Covers both direct physical losses and indirect losses stemming from a flood event • Additional Coverages – May include items such as debris removal or temporary living expenses incurred during repairs • Coverage Limits – Depends on location-specific risks and factors like elevation levels • Policy Limits – Can vary based on cost estimates provided by insurers.

In addition, it’s also wise to take stock of any extra protections offered under specific policies—such as provisions related to natural disasters like hurricanes or earthquakes—to ensure maximum security against all forms of unforeseen circumstances. With these considerations in mind, exploring additional protection options could be beneficial.

Additional Protection Offered

When it comes to purchasing flood insurance, there are additional protections available beyond the standard federal program. Private insurers such as Neptune Flood offer a private flood insurance market where consumers can buy separate home or business policies. This is distinct from the primary coverage limits of the National Flood Insurance Program (NFIP). Reinsurance for flood insurance may also be purchased through certain providers, which often leads to an increased uptake in flood policy purchases.

A quote acquired from a reputable provider should provide information on premiums and other costs associated with obtaining a separate flood policy. Understanding these details will help homeowners make informed decisions when weighing options for protecting against water damage associated with flooding events. Furthermore, this type of information should include what kind of losses would be covered by each policy, allowing customers to purchase adequate protection that meets their needs and budget constraints.

It is important to remember that while NFIP provides some coverage, additional protection in the form of private insurance companies may be necessary if more robust coverage is desired. Homeowners should consider all aspects of purchasing flood insurance before making any commitments.

Homeowners Insurance And Water Damage

Ironically, many homeowners may think they are protected from water damage by their standard homeowner’s insurance policy. In reality, the level of protection offered is often insufficient for flooding or flash floods in certain areas known as Flash Flood Alley—an area stretching across 11 states in the south-central US. Additional flood insurance coverage is strongly recommended to ensure a higher degree of safety and security against flood risk scenarios.

Floodplain management ordinances exist to help people understand the risks associated with living in an area prone to flooding. These regulations vary between localities; however, even if your property doesn’t fall within one of these designated zones, you should still consider investing in additional stand-alone flood policies for greater peace of mind. It is also highly advised to consult certified flood insurance counselors who can provide guidance on current flood insurance systems and calculate your potential annual flood risk.

While buying extra coverage can seem like an expensive burden upfront, doing so will save time and money if any unfortunate circumstances arise due to water damage. Understanding unresolved maintenance issues and water damage can keep you better prepared for future disasters and ultimately protect what matters most: your home.

Unresolved Maintenance Issues And Water Damage

The impact of water damage on a home can be devastating, and unresolved maintenance issues present an increased risk. In the case of flooding, even a tiny inch of floodwater can result in thousands of dollars in damages to personal belongings and valuable papers. The influx of tidal waters or runoff from surface waters poses an even greater danger, as do dangerous flash floods that are increasingly common due to climate change. Homeowners should check with their insurance company to determine if they have adequate coverage for excess water and what options for government compensation may be available.

Unfortunately, many don’t realize traditional homeowners’ policies generally exclude water backup from an outside sewer or drain. This means that standard insurance plans will not cover these types of disasters unless the homeowner has purchased additional flood insurance. As such, it is essential to consider purchasing a separate policy that covers this type of freshwater backup before disaster strikes and causes costly damage.

Homeowners need to understand the risks of potential flooding to protect themselves and their families against financial losses associated with unexpected water damage. Taking steps to purchase appropriate levels of flood insurance could save them time and money when faced with expensive repairs related to flooding events.

Water Backup From An Outside Sewer Or Drain

Water backup from an outside sewer or drain is a type of flood damage that can be financially devastating for homeowners. It’s like a ticking time bomb since most lending institutions require coverage, and many don’t understand the limited scope of traditional homeowner policies regarding flooding. Depending on various factors, such as the types of coverage available in your area, you may need to purchase a separate policy or excess flood endorsement to secure adequate protection.

In some cases, federal disaster assistance might cover damages if your property is affected by natural disasters such as hurricanes, tropical storms, and tornadoes. However, due to soft market conditions in certain areas, no commercial structures are available through private insurers, which means voluntary market structures must be explored.

It is important to remember that even with these options, additional coverage may still be necessary depending on where you live – significantly if you want to help protect your home against flooding beyond what insurance companies will offer in your region. Taking the extra steps now could save you tens of thousands of dollars later in the event of water backups from external sewers or drains.

Additional Coverage To Help Protect Your Home From Flooding

When protecting your home from flooding, there is much to consider. From emergency management agencies that enforce sound floodplain management standards to the actual cash value of damage covered by insurance, a proactive approach toward safeguarding your property can make a world of difference if a disaster strikes. The risk for flooding depends on factors such as low-risk areas or worst flash flood events with a return period of several years; even when you may not be required to purchase coverage from your mortgage company, additional coverage is highly recommended.

In addition, tropical storms and other natural disasters pose an ever-increasing threat when it comes to potential damages incurred from flooding. Knowing what form of protection works best for you can provide peace of mind and ensure that any losses sustained will at least partially be recovered through insurance claims.

From understanding how specific policies work regarding covered damages associated with floods to recognizing the importance of purchasing coverage regardless of location – being prepared ahead of time is essential for anyone wishing to protect their home against potential catastrophe.

Is Your Home At Risk For A Flood?

In the face of rising sea levels, melting glaciers, and increasingly powerful storms, it is easy to imagine why many homeowners ask themselves: ‘Is my home at risk for a flood?’ With the rapid accumulation of water throughout low-lying areas due to heavy rains or high tides often leading to flooding, the unaffordability of flood insurance has become an issue. This is mainly because capital market conditions have led to soft reinsurance market conditions that can affect property δread in future periods and during prolonged periods.

Primary insurers continue to look for ways to offer coverage, but with government compensation becoming less available, individuals may be left on their own regarding damaged belongings. One potential solution lies in private flood insurance, which provides additional coverage beyond traditional policies from primary insurers. This type of policy could save thousands if a disaster does occur, as it would protect against damages caused by floods.

As such, assessing one’s risk profile for flooding should be part of any homeowner’s financial planning process, and taking appropriate measures should never be neglected. Flood insurance eligibility with Neptune Flood can help ensure you are adequately covered in case tragedy strikes – something no homeowner ever wants to consider but must consider nonetheless.

Flood Insurance Eligibility With Neptune Flood

Many people have questions about purchasing flood insurance. According to the Insurance Information Institute, only twelve percent of American homes are covered by a flood policy. Eligibility for flood insurance with Neptune Flood is an essential factor in determining whether or not you will be able to purchase coverage.

The eligibility requirements for Neptune Flood vary depending on your location and other factors related to potential flooding risk. To qualify for protection from this insurer, homeowners should meet specific criteria, such as being in a high-risk area, meeting particular building codes, and having no history of repeated flooding incidents. Additionally, some locations may require additional disaster assistance funds for individuals who receive government compensation after costly disasters. Here’s a 3-item checklist homeowners should review before considering buying flood insurance: 1) Check local regulations & policies; 2) Research if there’s any history of floods in their area; 3) Determine what type of coverage they need (i.e., residential vs. commercial). These steps can help homeowners evaluate their eligibility when purchasing flood insurance with Neptune Flood. Completing these steps can lead to getting a quote and ultimately buying online at an affordable rate that meets individual needs and budget constraints.

Getting A Flood Insurance Quote & Buying Online

Purchasing flood insurance requires a precise understanding of the various elements involved. Gaining an accurate quote is the first step, and buying online often provides convenience and cost savings. To unlock these benefits, buyers must navigate through the maze of government policies and alternative sources of compensation or disaster assistance available.

For those wishing to purchase flood insurance, several options exist for obtaining a quote and engaging in the purchasing process online. Government-backed programs such as The National Flood Insurance Program (NFIP) provide coverage for residential and commercial property owners who live in areas at risk for flooding. At the same time, private insurers offer additional coverage, which can be bought separately from NFIP plans. Private insurers typically have websites where customers can get quotes over the Internet directly from them without contacting an agent. In addition, some companies may even allow policyholders to buy or renew their plans online via mobile devices or desktop computers.

Understanding all relevant aspects is thus essential when purchasing flood insurance online. From researching different types of plans and obtaining quotes to comparing rates among other providers, there are many factors one needs to consider before taking out a policy – not least getting familiar with what kind of coverage you need for your specific home or business situation. Knowing this information beforehand helps ensure that individuals make informed choices when selecting a plan that meets their individual needs best, allowing them to benefit from potential cost savings due to discounts offered by certain companies as well as any further financial protection provided by alternative forms of compensation and disaster relief services if needed.

Frequently Asked Questions

How Much Does Flood Insurance Typically Cost?

The cost of flood insurance is an essential factor to consider when purchasing coverage. Flooding can cause extensive damage, and the costs associated with repairs can be significant, so homeowners need to understand what their policy covers and how much they will need to spend on premiums. Here are some key points that should be considered when determining the typical cost of flood insurance:

1) The National Flood Insurance Program (NFIP) provides standardized policies at affordable rates. Premiums vary depending on location, building occupancy, age of structure, and other risk-related characteristics. For example, higher premiums may apply if your home is in a high-risk area or is over 40 years old.

2) Your premium amount also depends on the type and amount of coverage you select. Generally speaking, basic policies cover structures up to $250K and personal property up to $100K—but additional coverage options are available for an additional fee. Additionally, NFIP allows policyholders to purchase excess flood insurance from private insurers for enhanced protection beyond these limits.

3) Another factor influencing the rate is deductible amounts; lower deductibles result in higher premiums, while higher deductibles mean lower premiums but more out-of-pocket expenses following a claim. It’s essential to choose deductible amounts carefully based on budget considerations and expected losses due to flooding events.

When calculating the total cost of flood insurance, several variables must be considered, including national program availability and coverage levels, along with individual risk factors like geographic location and construction materials used in the home. By considering all of these elements together, it’s possible to determine which policy offers the best value for your money without sacrificing adequate protection against potential financial loss due to flooding events.

Is There A Difference Between Flood Insurance And Homeowners Insurance?

Knowing the difference between flood insurance and homeowners insurance is essential in a world of ever-changing weather patterns and increasingly frequent natural disasters. Taking out both policies offers more security than alone, like two pieces of a jigsaw puzzle coming together to form an overall picture.

Flood insurance differs from traditional homeowners policies in several ways. Firstly, it covers water damage caused by floods, mudslides, or heavy rains, whereas standard homeowner’s insurance does not cover these damages. In addition, for flooding incidents, the amount insured will depend on your property’s location relative to any nearby bodies of water or rivers that could be affected by rising waters due to storms or other climate events. Furthermore, unlike homeowners insurance, which typically protects against theft or fires, flood insurance may also cover clean posts following a disaster, such as removing debris or pumping sewage back into the sewer system after a storm surge has inundated properties with wastewater.

Ultimately, having both policies can help ensure you are fully protected should your area become subject to flooding or other extreme weather conditions. While homeowners policy will protect your investment under most circumstances, adding flood coverage gives extra peace of mind, knowing that you have taken additional steps to safeguard yourself financially when nature chooses to strike unexpectedly.

How Long Does It Take To Get A Flood Insurance Policy?

Flood insurance is a crucial purchase for any homeowner, but navigating the process can be overwhelming. With so many questions and variables, it’s hard to know where to begin; understanding how long it takes to get a flood insurance policy is a good place. As with most things in life, the speed of obtaining a policy depends on various factors—but there are ways to expedite the process and get coverage quickly.

The time needed to acquire flood insurance varies from person to person, almost as fast as lightning striking twice at once. Factors like location, type of property, and level of risk assessment required by an insurer are all reasons the timeline may differ between applicants. Moreover, if the house has already been flooded or needs specific repairs before being approved for coverage, it could also extend the period until approval.

Despite these potential delays, getting a flood insurance policy doesn’t have to take forever. In some cases, if you can provide proof that your home meets specific requirements, such as elevation certificates or engineering reports, this might reduce processing times significantly. It’s always wise to shop around, too; different insurers will offer varying levels of service that come with their turnaround times, so don’t forget to compare them when considering purchasing a policy. Swiftly taking action now can save you immense heartache later should disaster strike your area!

Is Flood Insurance Mandatory In Certain Areas?

Like a lifejacket in rough waters, flood insurance can provide critical protection for those in areas prone to flooding. In certain places, this type of coverage is not only recommended but also mandatory. Understanding if and when flood insurance must be purchased can help people make the right decisions regarding their financial security.

Depending on where you live, the law may require that all homeowners obtain flood insurance before they are allowed to close on their homes. For example, many municipalities located along bodies of water or coastal regions have laws making it compulsory for residents to carry this policy. These policies typically cover both structural and personal property damage caused by flooding.

In addition to being legally mandated in some locations, there are other scenarios that could necessitate purchasing a flood insurance policy. Mortgage lenders often require borrowers living in high-risk areas to get covered by such an insurance plan before giving out loans, regardless of local regulations. Furthermore, even if your home does not fall within a designated high-risk area, you might want to consider obtaining a policy since natural disasters can occur without warning at any time and place.

Therefore, researching your particular locale’s requirements and considering potential risks could prove invaluable should disaster strike and leave you exposed financially without protecting yourself from its aftermath.

Does Flood Insurance Cover Losses Due To Heavy Rain And Flooding?

Whether flood insurance covers losses due to heavy rain and flooding is essential. While it is true that conventional property insurance policies do not provide coverage for floods, flood insurance can be purchased separately to cover such risks. It should be noted, however, that some claims may be denied if a storm or hurricane caused the damage before the policy was in effect.

Flood insurance provides financial protection against water-related damages resulting from storms and other natural disasters. Coverage includes structural damage, personal possessions inside the structure, associated cleanup costs, and reimbursement for temporary living expenses during repairs. Flooding must meet specific criteria to qualify for coverage; for example, rising waters must exceed two feet above ground level before any claim can be made.

Different premiums are available depending on factors such as location and risk assessment scores. The cost of these premiums varies between insurers but typically ranges from several hundred dollars per year up to thousands of dollars annually, depending on the amount of coverage desired. In addition, homeowners may choose higher deductibles to reduce their overall premium payments while providing adequate coverage when needed.

Conclusion

Landing flood insurance is essential for those living in areas prone to flooding. It can provide a necessary layer of financial protection and peace of mind during rising waters. Like the sturdy foundation beneath our homes, flood insurance offers solid coverage for homeowners when disaster strikes.

When evaluating potential policies, it is crucial to understand what types of losses are covered by the policy, how much these services cost, and if they are mandated in certain areas. Knowing this information allows individuals to esecure their investmentsfrom damage caused by floods or heavy rains.

Ultimately, the choice to purchase flood insurance comes down to individual risk tolerance and budgeting abilities; however, like rain boots on a rainy day, it may be wise to have some extra protection ready just in case. By carefully researching available policies and weighing options, one can ensure they will remain protected against unexpected weather-related damages.

If you are looking for a reliable and affordable Homeowners Flood Insurance policy in Florida, you should consider contacting iInsure. iInsure is an independent insurance agency specializing in providing comprehensive coverage for homeowners throughout Florida. When you get iInsure, you can speak with an experienced agent who can help you find the best policy for your needs and budget.